First and foremost, congratulations!!! You are now parents! Welcome to a world full of little sleep, long nights, and the best kind of love anyone could ask for. You are navigating uncharted territory as you figure out this parenting thing. You just had your first kid and there are probably a million and one things you’re thinking about right now, when your brain has had enough sleep to think anyway. We’re pretty sure that Estate Planning is not one of them, but it should be. There are a ton of reasons that you should be thinking about estate planning right now, but we know you’re tired, so we’ll just give you our top 5.

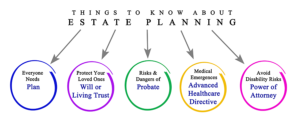

1. Having a plan is important.

As spontaneous as you may have been, may want to continue to be, currently are, when you have a kid, having a plan is important. There’s so much in the world that is unexpected, and we can’t plan for those things, but we can plan for the unexpected. We can provide a road map for what we want for our kids, for their future, for their upbringing.

The time to set that up is now, before the unexpected comes. Before it’s too late. Having a plan for how you want your estate to be handled in the event that you and your spouse are both gone (as grim as that is to think about), is essential. No one wants to deal with logistics during times of grief and emotional turmoil, have a plan now, so no one else will have to do the guesswork of what you would have wanted for your child(ren).

2. You have a child to think about.

We know this may seem obvious, but it’s not. Having a kid is a GREAT reason to start estate planning. Now that you have a kid, you’re probably experiencing some of life’s biggest highs – there is nothing better than the love of a child. But, it also means, you now have a child to think about. If something were to happen to both you and your partner, who will take care of your child(ren)?

Would your family fight over the child? Yes, no, maybe so? Even if they wouldn’t, it takes the burden off of your family during an already tragic time. It also removes the awkwardness of having someone feel the pressure to step up because they feel obligated to, versus someone who steps up because they want to.

Do you have family members that would want to raise your child in your absence but due to age, health, or a variety of other reasons may not be the best fit for raising your child? If the answer is yes, you should have an estate plan that is thinking of your child first, no matter what.

Having a plan allows your family members to know about your plans, and focus on your child instead of the logistics, during a grief filled time.

3. Family Values – preserve how your child is raised.

As new parents, you’re always thinking about your child first, and the thing you may not think about enough is, what happens if both of us are gone? Who preserves our family values and how our child will be raised?

Does that person have the same religious beliefs? The same political beliefs? Will they provide a good home for your child? Do you have family members that when you are asked “would they raise your child” and you say absolutely not?

Do those things matter when you and your spouse are thinking about who would provide for your child after you’re gone.

4. Provide for your child(ren).

All good estate plans should include will and trusts for your children. This will ensure you the opportunity to declare who you want to have legal custody of your child and protect their physical assets. Your trust will provide a way for your family to take care of your child. They will manage the assets for their care, education and other needs. Your will lays out who legally has legal custody of your child – this helps to minimize surprises, fighting, and other “fun” situations that can arise when there’s no plan in place.

No one loves our children more than parents, so it’s hard to imagine being the ones who aren’t raising them, but, if the unexpected happens, create a plan to provide for your children (heart, mind, but also, quality of life and assets too).

5. Peace of Mind

The last thing you need as a new parent is a longer to-do list however this will give you peace of mind that your affairs are in order and your family is taken care of. This should include a power of attorney/health care directive, which isn’t related to your children but these documents are necessary for you and your spouse.

You have plenty on your plate, so why do you need to add more stuff, you may ask?! Why now? I want to enjoy my family. The truth is, now you have a kid, and with that, comes great responsibilities. Once you have made an estate plan the hard part is over! Now you can go back to enjoying the late nights, long days, first laughs, first walks, and all the other highs and lows that come along. As your family grows and changes you can modify your estate plan to match your family and their needs.

Gone are the days of irresponsibility (well, mostly anyway) and here are the days of doing exciting stuff like… estate planning. What are you waiting for? Jessica Henman Attorney at Law, has everything you need to create an estate plan that’s right for you. Check out our shop here.

Jessica Henman, Attorney at Law, is based in Chico, California (born and raised in fact) and is here to help out anyone in California. Give me a call at (530) 520-3109 or email me to set-up a time to talk about getting the right estate plan, trust, wills, and other documents for your family. Whether you’re a family with young kids or a family with grown ones, I can help you every step of the way.

I look forward to connecting with you! I’m here to help answer any questions you may have regarding estate plans.