Some of you have certainly heard the term “probate” before, but maybe you aren’t exactly sure what it means and why you want to avoid it with a ten-foot pole (and then some). I deal with the term and the process every day, but I realized it can be easy to overlook the basics when helping people understand why they need an estate plan and an experienced attorney on their side.

Because it’s my job to help you navigate the ins and outs of how the legal system impacts your life, I want you to have all the information you need to make the right decisions for yourself, your family, and your future. Let’s talk about probate, so, hopefully, you’ll make an estate plan and never have to think about it again.

What is probate?

Simply put, probate refers to the legal process of administering the estate of a deceased person, which involves verifying and distributing their assets and property to the intended beneficiaries or heirs. The process involves submitting the deceased person’s will (if there is one) to the court, paying off any debts, and distributing the remaining assets according to the will or state law. The not-so-simple part? Probate can be a daunting and time-consuming process, which is why many people opt for estate planning measures to avoid it and ensure a smoother transfer of their assets to their loved ones after their passing.

Probate can be a daunting and time-consuming process, which is why many people opt for estate planning measures to avoid it.

10 types of assets that may be distributed

During probate, the assets that may be distributed to the beneficiaries of the deceased person’s estate can include:

- Real property, such as a house, land, or a vacation home

- Personal property, such as furniture, jewelry, and artwork

- Bank accounts and other financial assets, such as stocks, bonds, and retirement accounts

- Business interests and assets, such as shares in a company or intellectual property

- Vehicles, such as cars, boats, and planes

- Life insurance policies and proceeds

- Debts owed to the deceased person, such as loans or unpaid wages

- Claims or lawsuits that the estate may have against others

- Royalties or other income streams from creative works or patents

- Any other assets that the deceased person owned at the time of their death.

Why you want your estate to avoid probate

In the event of your passing, your family will be the ones who have to deal with the probate process. Without the proper documentation, trusts, designated beneficiaries, and an attorney in place to handle the proceedings, the state of California will have its say over how your assets are distributed and the process will take its sweet time, all while costing your loved ones an arm and a leg. Beyond the grief your family will be feeling, not knowing how to handle your estate can cause confusion, conflict, and a whole lot of stress.

3 common complaints about the probate process

- It is a lengthy process. Even in the smoothest probate cases in which a will is present, the proceedings can take anywhere from nine months to a year-and-a-half. In the situation of a constested will or the complex distribution of assets, the process can take even longer.

- It is an expensive process. In California, the associated fees can include court filing fees, appraisal fees, executor fees, attorney fees, and other related expenses. While the exact amount varies, depending on the size and complexity of the estate, the total fees can range from 3% to 8% of the total value of the estate. These fees can quickly add up and reduce the amount of assets left to distribute to beneficiaries.

- It is a public process. While I would assume you have no dirty laundry to hide, everyone deserves the right to their privacy. What happens in probate court does not stay in probate court and any information about your estate and the proceedings will become a part of the public record.

How to avoid probate

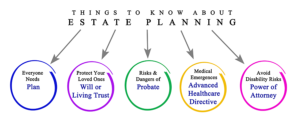

One of the best ways to avoid probate is to consult with an estate planning attorney. They can help you create a comprehensive plan to transfer your assets to your beneficiaries outside of probate. This ensures that your wishes are carried out smoothly and efficiently. If you choose to work with me on your estate plan, I will help you in setting up a living trust, which allows you to transfer your assets to the trust while you’re alive. The trust assets pass to your beneficiaries after your death without going through probate.

Additionally, I can help you create other important documents such as a durable power of attorney, healthcare directive, and a will, which can also help avoid probate in certain circumstances. With the help of an experienced estate planning attorney, you can feel confident that your assets will be distributed according to your wishes and with minimal stress on your loved ones.

Jessica Henman, Attorney at Law, is based in Chico, California (born and raised, in fact) and is here to help out anyone in California. For more assistance and custom estate planning advice, give me a call at (530) 520-3109 or email me to set-up a time to talk about getting the right estate plan, trust, wills, and other documents for you and your family.

I look forward to connecting with you! I’m here to help answer any questions you may have regarding probate and estate planning!