You get to a certain age or phase in life, and all of a sudden, it’s time to start planning for your death. You think you’ve finally got it – a partner, a few kids, a house – and then – BOOM – now you have to start thinking about your death? You’ve gotten all the unsubtle messages about estate planning but do you know what an estate planner actually helps you do? It’s probably not what you think. If you do know, go ahead and skip over this article, but if you’re curious what an estate planner can help you with, and how it can change your legacy, keep on reading.

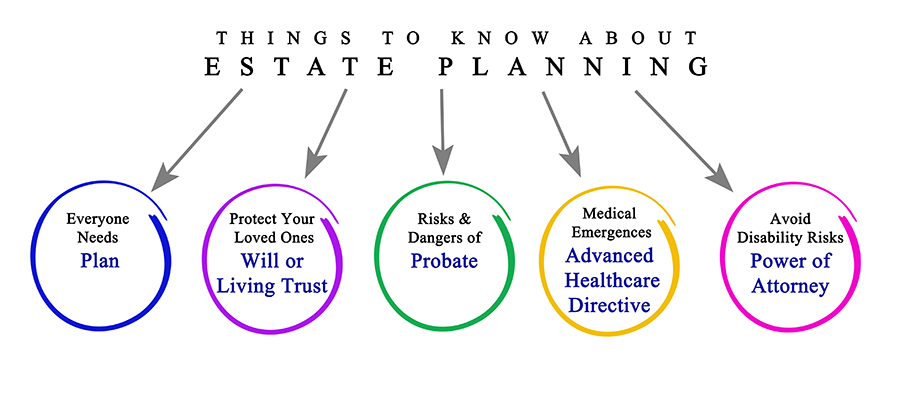

If you don’t know what an estate PLAN is, well, you’re in trouble. Just kidding! To put it briefly, an estate plan is the process of making a plan for what happens to one’s assets after death. Estate planning happens while someone is still alive, to help prevent the assets from going into probate. An estate planner is someone who helps make this happen. How does an estate planner help make this happen you might ask? We’re about to tell you exactly what an estate planner can do for you.

An Estate planner helps you….

Know what legal documents you might need to prepare for.

Working with an experienced lawyer specializing in estate planning means that you have someone on your side to help walk you through the legalities of life after death.

You might not know what you need, and having an estate planner can help you figure out if you need a trust or if a will would be sufficient.

Prepare legal documents correctly!

An estate planner helps you prepare the necessary legal documents correctly. It’s important to have someone who knows about wills, trusts, and establishing durable power of attorney and advanced healthcare directive to help prepare your assets in case the unexpected happens.

An estate planner will help you customize your will (and other documents) without screwing it up! Seriously. They’ll help prepare your legal documents correctly.

Avoid Probate

Without a proper estate plan, your assets may end up going into probate and distribution will be determined by an administrator of your estate. They may or may not know how you would have wanted your assets to be distributed. Avoid probate by working with an attorney specializing in estate planning to help ensure that your assets are distributed by your wishes via an estate plan.

Working with an experienced estate planner means having someone help you work through how you want your estate distributed. Identifying how you want your assets to be distributed is an important part of creating an estate plan and avoiding probate.

Keep up with the latest laws

You don’t try to keep up with all the tax, inheritance, business laws do you? I’m exhausted just THINKING about all the laws there are that may impact your estate! It’s an estate planner’s job to get exhausted thinking about it though, it’s not your job. We’re busy keeping up with the latest laws so that you don’t have to.

Sit back, relax, and let an experienced attorney do their part to keep up with the latest laws. Your estate planner will work with you to update your estate plan accordingly

Identify how you want your assets to be distributed.

An estate planner can help you take all of your personal assets, personal wishes and concerns, and ensure that your assets are distributed exactly the way you want them to be. Having an estate plan helps give you a clear path to your assets.

An estate plan should consist of these four documents, advanced health care directive, durable power of attorney, pour over will, and a trust. Having a trust exempts you from probate.

If you do not have an estate plan, but you do have a will, you will still have to go through the probate process. Simply having a will does not make you exempt from probate. While you have control over how your assets are distributed, it’s more difficult doing it through the will and probate process.

Working with an experienced estate attorney to create an estate plan helps to ensure you have more control over what happens to your children, business, property and other assets.

An estate planner will help make this process as smooth as possible, and that your estate plan respects your wishes on distribution of assets. Create the legacy you want, the way you want it.

An estate planner will make sure that your estate plan respects your wishes on distribution of assets. Create the legacy you want, the way you want it.

Make a concise plan (duh).

The thing that an estate planner does after all is said and done, is help you and your loved ones create a concise plan. A plan for your last breath, a plan for your business, a plan for your home, a plan for your vacation home, a plan for your boat, a plan for your kids and, well, you probably got the hint. A plan for EVERYTHING.

An experienced estate planner is here to help you prepare the right legal documents and create a path for what to do with your assets after you have passed away. This is a document that should be ever evolving.

Hiring an estate planner is something that anyone with loved ones and assets should do – no matter how young and healthy you may be, it’s always a good idea to prepare for the unexpected.

Answer all your questions.

Working with an experienced estate planner means working with someone who is available to answer any and all questions you may have during the planning process. Your attorney may even have answers for you before you even know you have questions! There is nothing like hiring an experienced professional to help you navigate through the unexpected.

Have questions? Need help creating an estate plan? Jessica Henman is Chico’s favorite lawyer and here to help you every step of the way.

Jessica Henman, Attorney at Law, is based in Chico, California (born and raised in fact) and is here to help out anyone in California. For more assistance and custom estate plans give me a call at (530) 520-3109 or email to set-up a time to talk about getting the right estate plan, trust, wills, and other documents for your family. Whether you’re a family with young kids or a family with grown ones, I can help you every step of the way.

I look forward to connecting with you! I’m here to help answer any questions you may have regarding estate planning. Plan for the unexpected today!