As Americans, we’re taught to work hard, and more importantly, to play hard! Life is meant to be enjoyed, it’s meant to be lived. We don’t tend to talk about what happens if we die, we don’t always plan for the unexpected but the reality is, we should. This checklist will help your loved ones navigate through your death without the burden of unnecessary complications.

Here are 11 things you should do before you die:

Well, there are probably a lot of things you SHOULD do before you die, so to clarify, these are 11 things you should do to prepare your estate before you die.

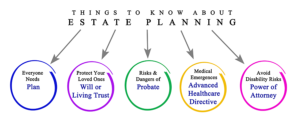

1. Have a Durable Power of Attorney

You have to create a Durable Power of Attorney , this gives someone the authority to help manage your financial affairs. Choosing someone to be your Durable Power of Attorney gives them the power to act in the best financial interest for you. Whether it’s your significant other, a child, or another loved one, make sure that you have someone that will be able to look out for your best interests in the event that you are unable to.

2. Have an Advanced Health Care Directive

Have you thought about what happens to you if you’re on life support or who would be responsible for making those decisions if something should happen to you? That’s why having an Advanced Health Care Directive is so important, it helps give your loved ones an exact plan for exactly what you want to happen to you, if the unexpected happens.

Having an Advanced Health Care Directive helps your loved ones navigate extenuating circumstances, with your guidance. How we live our lives, and how we leave it, should be up to us. Creating an Advanced Healthcare Directive, ensures that happens.

3. Have a Pour-over Will

Don’t forget to create a Pour-over Will! A Pour-over Will covers any of your assets that aren’t specifically laid out already in your trust. This means that any forgotten or leftover assets are protected and go into an already existing trust. Don’t let leftover items get forgotten about, otherwise it might become a more complicated process for your beneficiaries.

4. Have a Revocable Trust

If you don’t have a Revocable Trust yet, what are you waiting for? Also referred to as a Living Trust, this trust protects your assets before death AND after death. This type of trust can be amended and changed as your life and assets change. It’s an important document to have due to its flexibility. It is also incredibly important to transfer assets into the trust name once the trust is set up. Re-titling real estate, brokerage accounts, and bank accounts is a crucial step in completing your estate plan.

5. Decide how your remains will be handled once you die

It may come as a surprise to some of you, or maybe it won’t at all but people don’t always talk about how they want their remains to be handled once they die. It’s not intentional, it’s just kind of morbid for some people.

It’s important to think about what you want – cremation vs. burial then having your family make those decisions for you. Even in our death, we want to take care of our loved ones, and helping make these decisions for them so that they can focus on their grief, is helpful.

It is easier for your loved ones if you pre-pay and pick out how you want your remains to be. For example, if you want to be buried, choose which funeral home you want to use, pick out your casket/urn, have your plot paid for etc.

Once you have this information, you can leave it with your other estate plan info and your loved ones can simply reach out to the funeral home and follow your wishes.

6. Choose what charities you would like to gift to (if any)

If there’s a non-profit or charity that is near and dear to your heart, make sure that they’re included in your estate planning. Lot’s of non-profits have planned giving or inheritance/legacy gift programs that can make sure your intended non-profit beneficiaries are taken care of.

Your legacy can and will continue on after you.

7. Take care of your fur babies

If you have animals/pets do you have someone to take care of them in the event they are in the home when you pass.

Just like children, it’s a good idea to have someone dedicated to your fur babies that will love them as if they were their own.

8. Choose who you want to raise your children

Since the moment they are born, you put your entire life into loving and providing for your children. All you can think about is protecting them and keeping them safe. If you’re like me, you know you would do anything to protect them, but what happens if you’re not around to do that?

Have you thought about who you want to raise your children, incase of the unexpected? It’s not anything you want to think about but the time to know is now. It’s important to think about how you want your kids to be raised and who you want to raise them. It’s also important to ask them if that’s something they would want to take on. No one should be surprised by who is responsible for the kids, if something should happen to you or your partner.

Life is full of the unexpected so it’s better to be as prepared as we can be for those moments.

9. Update your beneficiaries

Nothing like going through a divorce for someone to remember it’s probably a good idea to update your beneficiaries. In all seriousness though, it’s always a good idea, as life changes and evolves, to make sure your TOD/POD accounts, life insurance policies, and retirement accounts are updated with current beneficiaries.

Prevent the family drama from happening later by preparing for it now, well as much as you can anyway.

10. Update Real Estate

Once your trust is established, take title to any new real estate in the trust name! Real Estate can be complicated, simplify it by putting your Real Estate into a Trust where everything is laid out.

A grant deed is important for anyone wanting to transfer real estate property from one person to another, including after death. There are a variety of reasons you may want to do this but make sure you have your real estate updated and documents taken care of.

Don’t wait until it’s too late! Once you have the trust set-up you can put any future real estate property into the trust name too!

11. Set up a trust bank account

A trust bank account is important because it allows trustees to pay for expenses, and disperse assets after a loved ones death! Only the trustee, not the beneficiaries, have access to this account. This ensures that funds and assets are distributed properly.

Still have questions about any of the 11 things you should do before you do, to prepare for your estate plan? Need help creating an estate plan in the state of California? Jessica Henman is Chico’s favorite lawyer and here to help you every step of the way.

Jessica Henman, Attorney at Law, is based in Chico, California (born and raised in fact) and is here to help out anyone in California. For more assistance and custom estate plans give me a call at (530) 520-3109 or email to set-up a time to talk about getting the right estate plan, trust, wills, and other documents for your family. Whether you’re a family with young kids or a family with grown ones, I can help you every step of the way.

I look forward to connecting with you! I’m here to help answer any questions you may have regarding estate planning. Plan for the unexpected today!