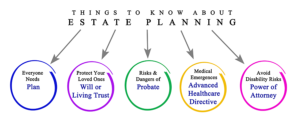

Welcome to the wild side of life! The side of life which consists of being responsible for others, being financially responsible-ish, and being a planner – even when life is full of the unexpected! At the end of the day, that’s what an estate plan is for, to help you plan for the unexpected.

As life starts to happen – as we build a career, a family, buying a home, etc. – the need for planning for our future and the unexpected becomes more important. No time like the present to start thinking about an estate plan! It can feel overwhelming as your assets start to grow – you may know you need an estate plan but do you even know what is included in an estate plan in California? Or what documents should be included? Don’t worry about it! I’ve got you covered.

Every California Estate Plan that I create includes 4-5 important documents. Let’s walk through the documents that should be included in a California Estate plan.

1. Advanced Healthcare Directive

Every estate plan in California should include these documents to help direct end of life care. This directive should help spell out how you want your care treatment to look like (or not to look like), and who is responsible for making these decisions.

Have you thought about whether or not you want to be on life support? Have you decided who you want to be responsible for those decisions if you’re not able to make those decisions? Ensuring you have an Advanced Healthcare Directive is one step in making sure that your life is carried out the way you want to, even if you may not be able to make those decisions. Our life and how we leave it, should always be our choice, ensure that happens with the right documents in your estate plan.

Documents included in this directive may be:

- Medical power of attorney

- DNR (Do-not-resuscitate)

Advanced healthcare directives are specific from state to state, which is just one of many reasons if you move from California to another state, or from another state to California, you’ll want to make sure your estate plan is updated.

2. Durable Power of Attorney

Similar to how a medical power of attorney gives someone the authority to help make medical decisions, a durable power of attorney gives someone the authority to help manage your financial affairs. Choosing a durable power of attorney ensures that you pick someone you trust to act in the best financial interests for you AND your family.

When you sit back and think about it, who would you trust to act on your behalf?

Don’t leave it up to the state or someone who won’t be able to honor your wishes, ensure you have a durable power of attorney so that when the day comes, your financial affairs will be in order, the way you want them to be.

3. Pour-over Will

It can be overwhelming sometimes when thinking about estate plans, wills, trusts, and all the infinite other documents that popup when trying to be a responsible adult. It’s exhausting! You’re probably sitting there thinking you finally have it all figured out and then someone mentions something like a Pour-over Will. We all know that feeling, smiling and nodding, acting like “Yes, sure of course we have that too”, waiting until the conversation is over so that you can quickly rush to google for answers to our questions. That’s probably how you ended up here, isn’t it?

A Pour-over Will is a legal document that covers any of your assets that aren’t specifically laid out already in your Will. These forgotten or leftover assets will automatically go to an existing trust, upon your death. Basically anything you missed or forgot about will be put into your trust upon your death.

Any Estate Plan in CA should have a Pour Over Will included! This will ensure all of your assets are protected.

4. Revocable Trust

A Revocable Trust, also referred to as a living trust, is set to protect your assets before death, and is something that can be amended over time. Revocable Trusts go into effect as soon as they’re created and signed. Every Estate Plan in the state of California should include this.

A Revocable Trust is always important because of its flexibility but especially if you’re young and your trust may continue to change over time (marriage, kids, asset growth etc).

This process helps to avoid your beneficiaries having to go through unnecessary probate, which can often be time consuming!

5. Grant deeds transferring Real Estate into a Trust

This is only applicable if you have real estate property (duh!) but it is important to do. This helps to ensure your property rights are transferred to the right person, it transfers the property from your personal name and puts it into your trust. Grant deeds are essential for anyone wanting to transfer real estate property from one person to another, including after death.

By putting your real estate property that you already own into a trust, you’re creating one less step and obstacle for your beneficiaries to worry about! Once you have the trust set-up you can put any future real estate property into the trust name too!

Using Grant Deeds to put your property into a trust does three important things:

- It funds the trust. To be valid, the trust is required to have property in it.

- It prevents things from being forgotten in the trust.

- It allows you to transfer property from your personal name into your trust name.

If you or a loved one were to purchase a property in your personal name, and then passed away, without having an estate plan, you will have to go through probate to transfer the title. Adding your real estate property into a trust helps complete your estate plan by ensuring that you can do this easily.

Still have questions about what documents are needed in a California Estate plan? Need help creating an estate plan in the state of California? Jessica Henman is Chico’s favorite lawyer and here to help you every step of the way.

Jessica Henman, Attorney at Law, is based in Chico, California (born and raised in fact) and is here to help out anyone in California. For more assistance and custom estate plans give me a call at (530) 520-3109 or email to set-up a time to talk about getting the right estate plan, trust, wills, and other documents for your family. Whether you’re a family with young kids or a family with grown ones, I can help you every step of the way.

I look forward to connecting with you! I’m here to help answer any questions you may have regarding estate planning. Plan for the unexpected today!